As an application of UBI, G-M300(4G OBD) developed by Shenzhen DragonBridge Technology is a technical means of professional detection of driver behavior habits. On the one hand, OBD provides insurers with valuable data on car insurance policyholders, which they use to increase or decrease premiums for the following year. On the other hand, it provides technical support for insurance companies to stabilize customers, and has already cooperated with Allianz, the largest insurance company in Europe, and Sicily By car rental company

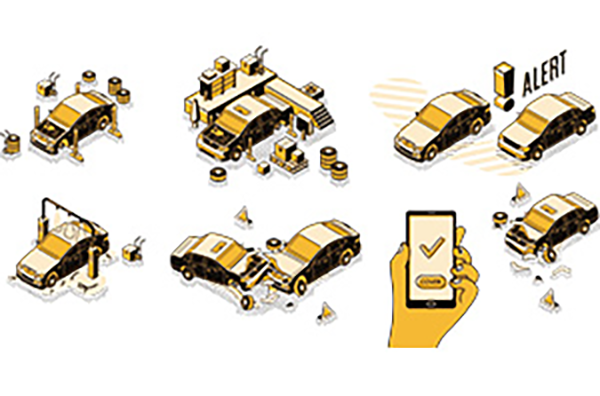

Usage-Based Insurance (UBI), as a data-based insurance model, can help insurance companies solve the following problems:

1.Personalized pricing: Traditional vehicle insurance is often based on statistics and a generalized risk assessment to determine premiums. UBI can personalize risk assessment for each driver by collecting vehicle driving data, such as mileage, driving behavior, time period, etc. This allows for more precise pricing, matching premiums to an individual's driving risk and reducing risk exposure for insurers.

2.Claims processing and fraud prevention: UBI records and stores vehicle travel data, which is valuable for claims processing and fraud prevention. When an accident occurs, insurance companies can analyze the data to restore the driving conditions before and after the accident, determine the responsibility and the cause of the accident. At the same time, UBI can also help insurance companies detect abnormal driving behavior, early detection and prevention of insurance fraud.

3.Customer engagement and insurance service personalization: Through UBI, insurance companies can interact with customers in real time, share driving data and provide personalized driving analysis reports. This can increase customer engagement and trust in the insurance company, improve customer satisfaction and insurance brand image.

Overall, UBI can help insurers achieve goals such as personalized pricing, driving behavior analysis and risk prevention, claims processing and fraud prevention, as well as customer engagement and personalization of insurance services. This data-based insurance model not only helps reduce risk exposure and claims costs for insurers, but also provides a better insurance experience and service.

Post time: Sep-19-2023